On September 18th, Nvidia announced a $5bn deal with Intel. Following the announcement, TSMC stock declined by 2.9% as investors speculated about a potential weakness in the semiconductor titan.

Nvidia’s $5bn investment into Intel connects Nvidia’s AI personal computing power with Intel chips and integrates Intel CPUs into Nvidia’s AI data center systems. TSMC remains as Nvidia’s primary chip manufacturer, as there was no mention of Nvidia utilizing Intel’s foundry business to manufacture Nvidia chips. Nvidia founder and CEO Jensen Huang praised their mutual chip manufacturer at the press conference, calling them “world-class” and saying, “[Nvidia and Intel] are both successful customers of TSMC’s.”

However, Nvidia has historically stressed the importance of supply chain diversification, especially amid growing geopolitical tensions. “All of our supply chain is designed for maximum diversity and redundancy so that we can have resilience […] We manufacture in as many places as we can,” said Huang in 2023. He also added that, “[Nvidia] manufactures with Samsung, and we’re open to manufacturing with Intel.”

While Nvidia’s and Intel’s CEOs confirmed their continued partnerships with TSMC, some analysts noted a potential opportunity for Nvidia to test Intel Foundry operations, as it falls in line with Nvidia’s past statements. “You potentially see Nvidia start giving some token business to Intel,” said CFRA Analyst Angelo Zino.

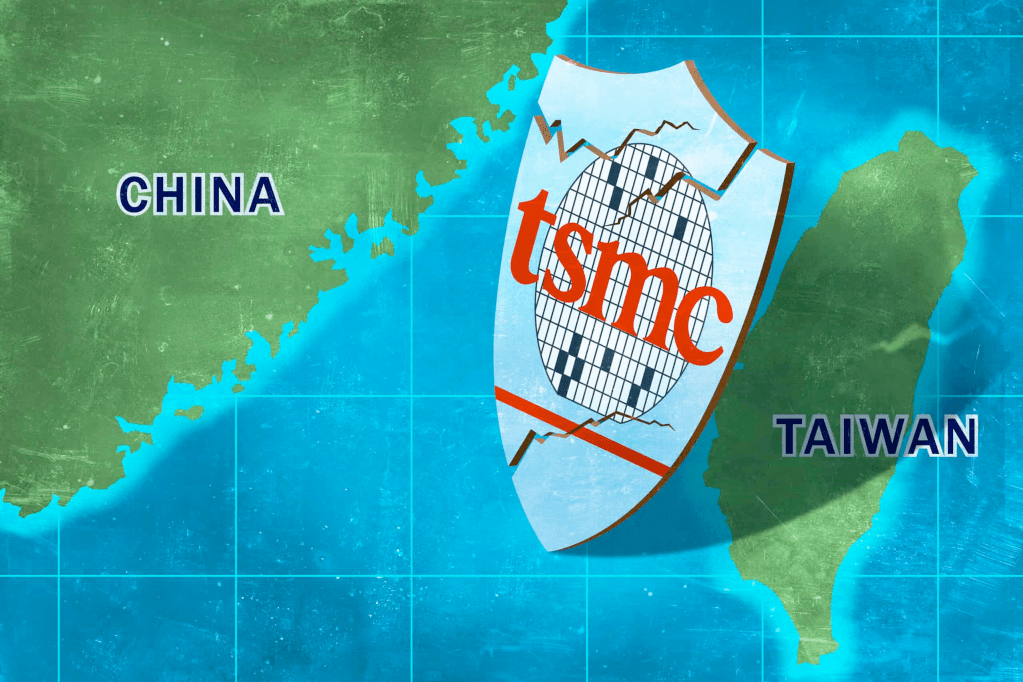

These speculations also bear in mind the longstanding concern over TSMC’s core operations located at the center of Chinese and American geopolitics. TSMC’s accelerated growth is referred to by Taiwanese locals as “the sacred mountain that protects the country.” However, this title also emphasizes a major shortcoming of the Taiwanese economy: “Growth that relies too heavily on one industry may look impressive on paper, but will feel less secure in practice,” says Alicia Garcia Herrero, reporter for Asia Times.

TSMC continues to manufacture over 60% of the world’s semiconductors and over 90% of the advanced ones, establishing a near monopoly on the international semiconductor manufacturing industry. TSMC has also begun expanding its operations, investing $165bn into US operations, totalling $190bn worldwide. The push for global expansion further solidifies its spot as a leading chip manufacturer and aims to accommodate international customers that Intel otherwise would have had an edge over.

While the deal drew optimism from investors, many others felt otherwise. On September 19, Citibank downgraded Intel stock from “neutral” to “sell”. Citi semiconductor analyst Christopher Danely commented that Intel’s foundry business will not be effective in competing against TSMC, adding that the foundry component “has minimal chance to succeed.”

Drawing attention to Intel Foundry Services, the business unit lost $13bn in the 2024’s fiscal year, doubling its losses from the previous year. In a June 2025 SEC report, Intel also stated, “We have been unsuccessful to date in securing any significant external foundry customers for any of our nodes.”

Investors and analysts have widely noted Intel’s performance as subpar. Since 2021, they have shown a steady downtrend in revenue. Analysts have also pointed out that for their foundry business to excel, it will require major investments, perhaps from Nvidia. However, Tim Culpan, a long-time journalist tracking the chip industry, stated, “Intel didn’t fall behind because of a lack of funds or equipment; it fell behind because of successive internal failures related to its approach to technological and business development.” While the Nvidia-Intel deal may serve as a reminder of the fierce competition in chip manufacturing, Intel has a long journey before it can dent Taiwan’s silicon shield.

Leave a comment