An economy with inaccurate economic data is about as safe as a vehicle with an unreliable dash. Yet a controversial termination, shocking revisions, and the politicization of independent data tells us an unreliable dash may soon sit at the wheel of America’s economy.

The success of America’s economy can be attributed to many factors: a robust culture for entrepreneurship, lucrative tax incentives for long term investments, or rigorous higher education programs. However, another force flies under the radar that the entire financial market depends on: economic data.

Sam Stovall, Chief Investment Strategist at CFRA Research says, “One reason that the U.S. is regarded as one of the better places to invest is the accuracy of the data, where the data is not manipulated by the government to satisfy whatever the government is trying to communicate.”

The Bureau of Labor Statistics (BLS) is at the center of providing sound economic data that gauges the health of the American economy. Everyone from corporations, policymakers, investors, economists, and consumers utilize this data to estimate the present and prepare for the future. The strength of the US economy and the quality of our data go hand-in-hand. Leading the world with a $30 trillion GDP, the US gaps second place by over 160% and demonstrates that, “US government data is and has been for a very long time, the gold standard,” says Kai Ryssdal, host of business program Marketplace

Over the years, the integrity of economic data has largely been underappreciated and gone unnoticed until recently. A string of events, going back two decades to this current administration, has put American financial market at the cusp of uncharted territories.

Why the renewed interest?

It is standard practice for the BLS to publicly update past reports in light of new information. This is usually done in tandem with the release of the current monthly or quarterly reports.

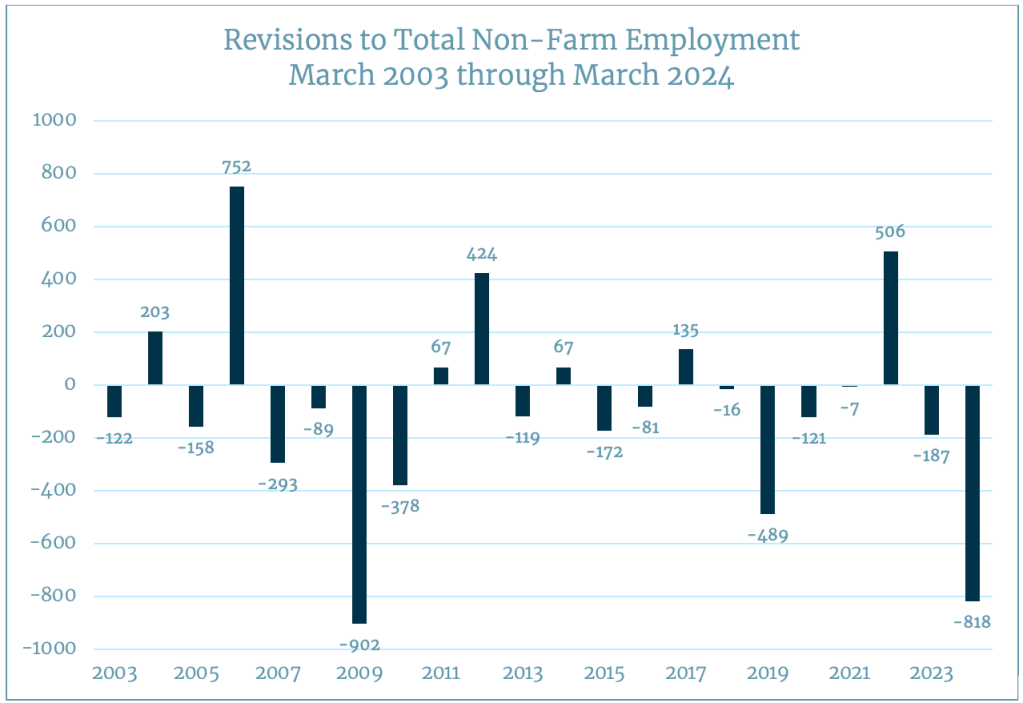

After releasing the monthly to quarterly reports to the public, it is standard for BLS to also revise previous reports in light of new information. What is not standard are significant or major revisions. In recent months, the financial markets saw two unprecedented, negative revisions to the jobs report.

In the July 2025 jobs report, May’s job gains were revised from 139,000 to 19,000 and June’s jobs gains were revised from 147,000 to 14,000. These slashes in gains were some of the largest revisions from the BLS in decades.

In September 2025, the BLS revealed another revision: between April 2024 and March 2025, the economy added 911,000 fewer jobs than previously estimated. To put this adjustment into perspective, the largest negative revision was in 2009 when job gains were reduced by 902,000. September’s revision also followed major downward revisions with a job reduction of 818,000 in 2023-2024.

Significant revisions like these reveal that the economy may not have been nearly as strong as financial markets thought and also creates an environment of uncertainty as initial readings may be interpreted as inaccurate or untrustworthy. Wells Fargo Economist, Nicole Cervi, comments on her recent analysis of July’s payroll report, “My immediate gut reaction is maybe I should not take that initial preliminary estimate for July. Literally, because we know that perhaps the preliminary quality is not great because of these issues with surveying.”

However, an even greater concern is brewing as the current administration has begun politicizing the numbers with President Trump going as far as firing the BLS commissioner, Dr. McEntarer, over the July revisions. President Trump’s decisions may seem justified but a look at the larger picture may tell otherwise.

The past up until now

To collect economic data, the BLS performs mass surveys on consumers, businesses, and about price of goods. These surveys remain accurate as long as response rates remain high. To ensure responses are timely, labor is needed to gather and calculate data, which requires funding to support that labor. Herein lies the first obstacle: Since 2010, the BLS funding has been cut by over 20%. A steady decrease in support to the BLS has begun revealing itself slowly but surely.

The response rates to BLS surveys have been steadily trending downwards, reflecting the steady decrease in funding.To put it into perspective, recent household response rates have fallen below 70% and overall unit response rates to surveys have fallen nearly 20% since COVID. Revisions are a result of lagging response rates; as responses worsen, the more significant a revision. While the data remains accurate, former BLS commissioner Erica Groshen calls this growing problem a “slow-moving train wreck.”

This problem is far from new but difficult to fix. Major agencies that calculate economic data are constantly researching ways to improve data processes and accuracy. However, underfunding and a pandemic are plenty large obstacles to hold government agencies back from optimal performance. And as if the data collection process was not problematic enough, the BLS faced DOGE layoffs in 2025.

Each data point measured by the BLS requires extensive labor. “I can’t help but worry some deadlines are going to be missed and undetected biases or other errors are going to start creeping into some of these reports just because of the reduction in staff,” Erica Groshen told Reuters. The BLS workforce was slashed by 20% after DOGE layoffs. As fewer people serve in the workforce, an already heavy problem now has fewer shoulders to carry the burden.

Yet, no end in sight. On Friday, August 1, President Trump fired the commissioner of the BLS, Dr. Erika McEntarfer following the July jobs report. He claimed in a Truth Social Post, “today’s Job’s Numbers were RIGGED in order to make republicans, and ME, look bad,” referring to the job’s report and revisions of May-July 2025, where the BLS reported that, “Revisions for May and June were larger than normal.”

The unexpected termination of the BLS commissioner created negative backlash from the financial markets. “Today was probably the last reliable jobs report we will ever see,” says Jody Calamene, director of Advocacy at AFL-CIO. “It calls into question whether this type of information can be trusted and is unbiased actually going forward. Because if the people collecting the data are subject to the political whims of the president, that can call into question the veracity of that data.” says Steve Sosnick, Chief Market Analyst at Interactive Brokers.

The BLS and other agencies that collect fiscal data are designed to be independent from political motives. Trump’s nomination for the new BLS commissioner, E.J. Antoni, is a pro-MAGA economist with no government experience. He stirred controversy in the economist world on both sides. “The articles and tweets I’ve seen him publish are probably the most error-filled of any think tank economist right now,” by Jessica Riedl, senior economist at the Conservative Manhattan Institute.

For the time being, William Wiatrowski will act as interim BLS commissioner until the senate votes on the candidate to succeed McEntarfer. President Trump has also proposed an 8% cut to the BLS budget in 2026. He further recommended the BLS to merge with other statistical government agencies such as the Bureau of Economic Analysis and the Census Bureau.

Final Thoughts

Dr. McEntarfer has made public comments since her termination. In a recent panel at her alma mater, Bard College, she points to countries that have removed statisticians over disappointing statistics stating, “The resulting loss of trust in economic statistics led these countries to worsening economic crises, higher inflation and higher borrowing costs.” She also adds, “In terms of the future, it is an uncertain moment.”

Since President Trump entered the Oval Office, uncertainty has become common slang in the financial world. For a very long time, markets could at least be certain of the data they were receiving. They understood the data was professional, non-partisan, and more importantly, irreplaceable. Questioning the quality of economic data is normal, healthy even, especially since the BLS faces real problems. However, President Trump’s approach feels less constructive and more of a blatant sabotage to the US economy and the relationship with its players. As economic independence is challenged and resources are strained, the American economy might find themselves asking a very difficult question, “Who can we trust?”