How it all started

They say you can never be too young to learn how to invest your money. I beg to differ.

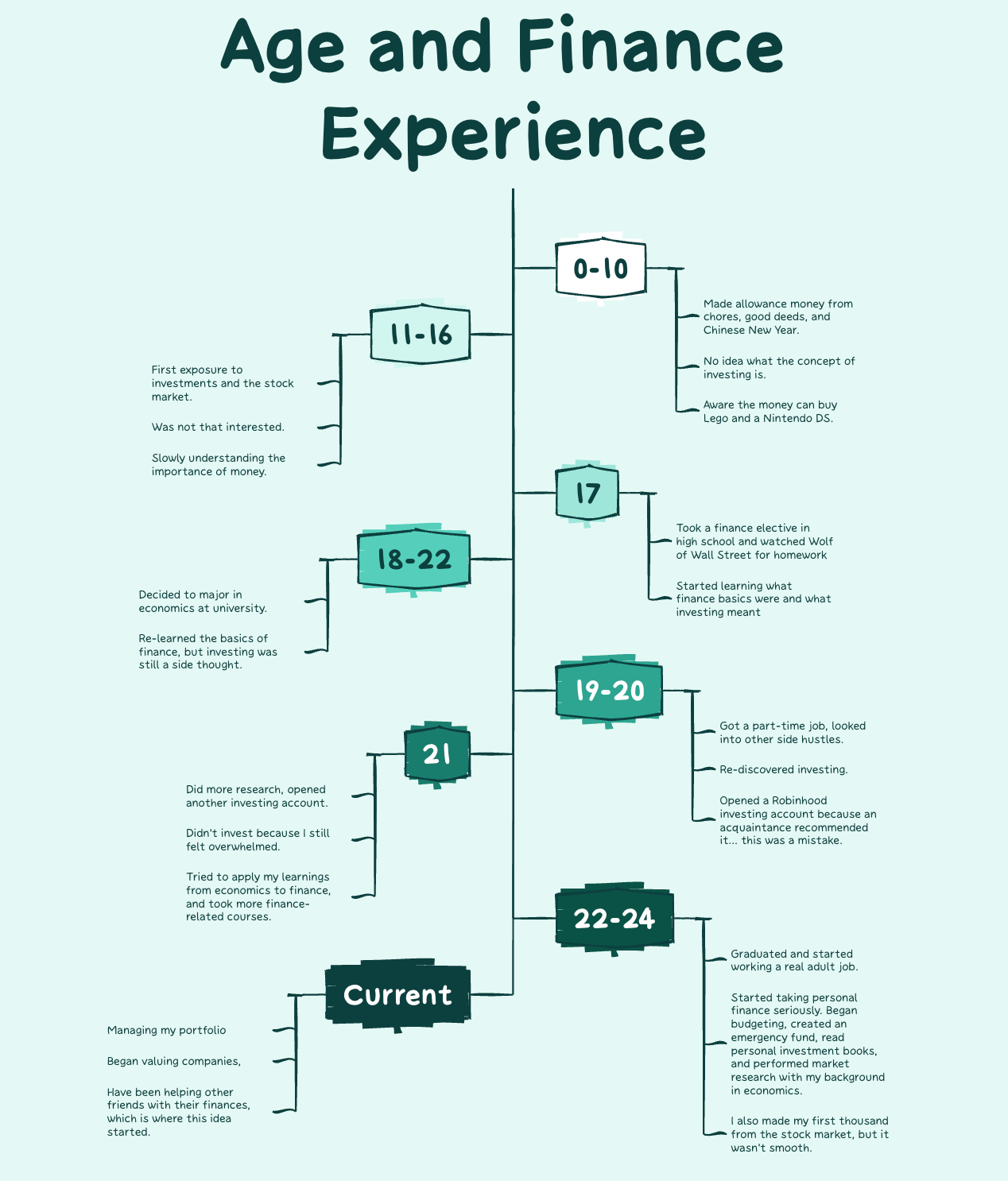

At 10 years old, my grandma showed me my first stock investment chart. She proudly pointed at her web of assorted colorful lines and bars and gleefully said, “This is how I make money!”

I smiled, nodded politely, and lost interest immediately. I was then held against my will as my grandma proceeded to explain what she does to make this so-called money.

“Look! I bought this stock here,” she pointed to a crux of a V-shape, “And then it went up, making me lots of money! Isn’t that fascinating? And then I use…”

I’m not sure what the rest of that conversation entailed. My mom saved her child from boredom shortly after, and the lesson left my mind as quickly as it had entered.

Every year since, my grandma tries to give me impromptu lessons about stock investing. For a very long while, it went in one ear and out the other. At first, I ignored it because I genuinely did not find it interesting. As I got older, I started to realize the importance of money, and my attitude eventually shifted from disinterest to confusion. Truth be told, even after countless investing sermons, I was still lost.

What is investing?

Why do we invest?

How do I invest?

How do I know when I’m right?

Where do I even begin?

As passionate as my grandma was during her lessons, she wasn’t a very good teacher. I ended up learning most of the basics on my own via digging through websites, books, looking up vocabulary, and hitting walls trying to understand the finance language. I would choose to study economics in college, which gave me a nice leg-up, but personal finance and investing were different beasts altogether. I spent the first few years of my investment journey learning the fundamentals, understanding headlines, figuring out who to trust, making mistakes, and being bold enough to invest at all.

What am I writing?

Finance content is somehow boring, fast-paced, and contradictory all at the same time. During my first deep dive into investing, I remember reading minute-by-minute headlines and opposing opinions on the same topics, thinking, “How can everyone be right?” I was overwhelmed with countless gurus and commentators claiming, “Buy this! Buy that!” without ever explaining what this or that was. Who do you trust when everyone is seems like an expert?

The problem with financial content is that it often forgets the beginners. I mean the real beginners. The ones who don’t know what investing is and are too afraid to ask, all while believing that a wrong financial decision will lead to tax fraud. This series aims to fix that.

My goal as a writer is to recount the steps I took to invest, explain what I have learned along the way, and what I would have done differently. It will not be financial advice, and I implore readers to do their own research after all, I am still learning, just like all of you. If you want to explore your financial options but feel overwhelmed, use my journey as a roadmap and tweak it according to your personal goals.

Investing After College is a digestible series written for beginners, recounting my experiences in economics, finance, and investing. The roadmap and all the topics I plan to talk about, are below.

The Roadmap

Final Thoughts and What’s Next

Investments and personal finance really are that important. There is a reason why every ‘adult’ talks about it. Yet, it is baffling how an essential concept like this are left half-explained and up for interpretation. When I first started investing, I tried searching for a resource like this and only got snippets of other people’s experiences. Hopefully, by stumbling upon this series, you won’t feel nearly as frustrated as I did.

Now that we’ve got icebreakers out of the way, you are probably wondering, “What the heck even is investing?” Next week, I cover exactly that – a simple explanation packaged with a nice analogy to kick everything off.