When I didn’t understand the meaning of style, I looked to Nike for inspiration. When I finally gained some inkling of fashion, I thought a large checkmark would tell the public I knew what I was doing. Like many young men, the swoosh guided me out of a styleless dystopian into some version of color coordination. Only recently, after looking at my current collection of shoes, did I realize that the long-standing Nike was barely in the rotation.

Dress shoes for events, New Balance for work, Asics for working out, Tigers for the weekend, and Nikes? Dirtied and off to the side.

I could’ve attested this to my style maturing until I read the headline: “Nike has just named Aaron Cain as the new CEO of Converse, to replace Jared Carver due to slow sales and rising competition in athletic wear.” That’s when I remembered Nike’s got a new CEO as of late 2024. And then came a rabbit hole into the market of Nike.

Scenario #1: Short and Bearish

Tariff pressures, negative revenue growth, new competitors, and a decrease in resales; these numbers tell the story of a bleak future and a flourishing environment for short-sellers. It’s no question that with a sharp decline in the stock price and questionable retail decisions, Nike faces a serious mountain ahead of it, one that might not be able to be climbed.

However, there is another view on this bearish situation that might be unique to those in the fashion/footwear industry.

Scenario #2: Fashion Boom

The end of Nike is challenging to imagine, and let’s be honest, everyone calling out the end of Nike is ignoring the $50B in revenue last year and the year before that. Nike’s new management and a competitor’s revitalization may suggest that there is a light at the end of the tunnel.

Both futures are built on the foundation of a bearish future. Even in scenario #2, I believe Nike must have a significant drop in stock price in order for that scenario to be viable. Nike is like scrooge with the past, present, and future haunting its the company. The next section will delve into the break down of those features.

The Future – Tariffs, Manufacturing, and Supply Chain

Trump’s tariff announcements on Asia, specifically Vietnam, Indonesia, and China is the newest hurdle for Nike to jump. Nike’s manufacturing comes directly from those select countries. While no deal has been finalized, these threats of supply chain constraints can certainly depress the price and negatively impact earnings as the cost to manufacture will increase.

Trump has made a point to say that the goal of these tariffs is to bring back manufacturing in the US. It is unlikely that tariffs alone are a financially substantial enough reason to bring manufacturing back as costs are estimated to be in the billions.

Speculation have claimed that instead of moving manufacturing to US, Nike could move to India, which could still create heavy expenses in the shoes. Another commentator, Peter Schiff, has argued that Nike won’t move its manufacturing but instead move its target audience away from the US and towards other international countries instead.

All this to say, if tariff deals continue to progress, Nike might just have to raise their premium prices after all.

Nike’s Moveaway from wholesale

I believe this pain point comes in two parts: Nike’s decision to move away from store sales and focus on digital sales in the years post 2020 and the capitalization by competitors with strong niches. To sum the problem all together: consumers have object permanance.

Nike discontinued many of its wholesale relationships with partners such as Amazon, DSW, Macy’s, and Footlocker 2020, converting to a direct-to-consumer strategy, focusing its might on digital.

In the coming years, revenue was brought into question, and eventually, Nike returned to the wholesale scene sometime in 2023.

This move had its consequences. Adidas, New Balance, Sketchers, as well as newcomers such as Hoka and On took advantage of the missing star of the show. This new exposure to new brands paved the way for more options for consumers, and potentially starting the trend away from Nike.

Falling Revenue and Resale Value

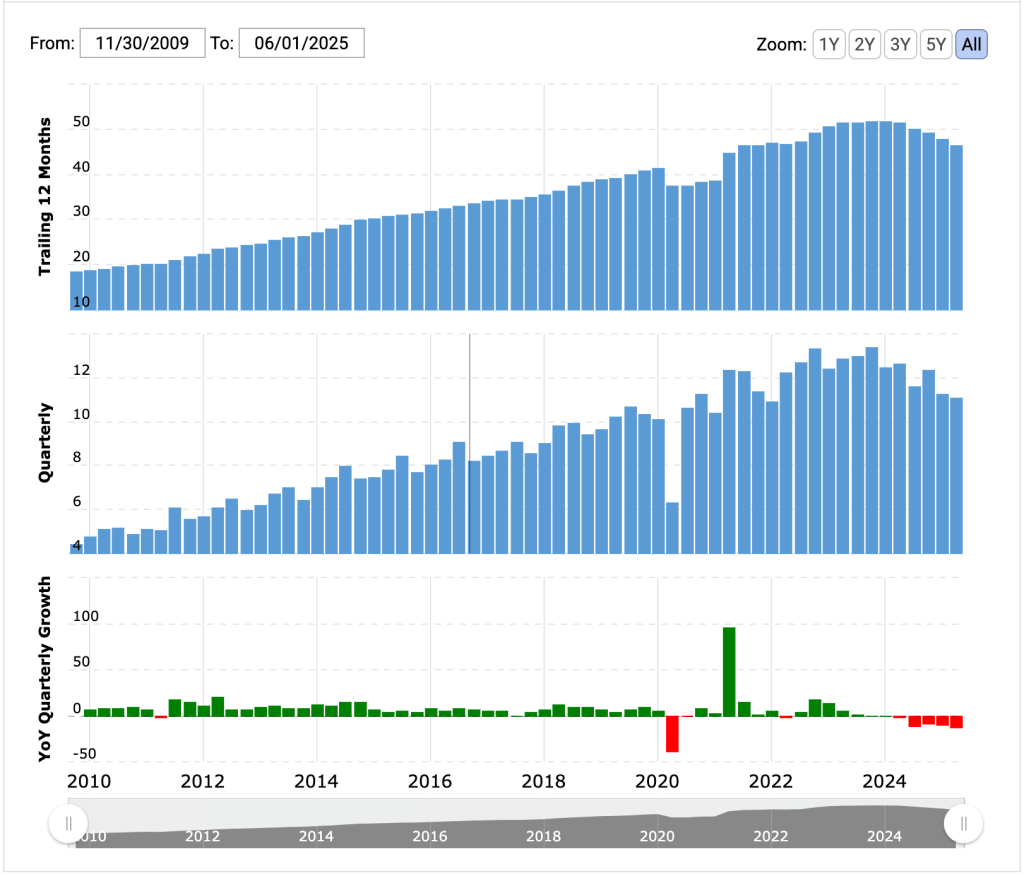

Starting in 2023, Nike started exhibiting signs of decrease in revenue. Since then, the company has shown a steady downtrend in revenue, representing a loss in demand in the company’s products and services.

However, what is even more alarming is the decrease in resale value. The sneaker world prides itself on vintage trends and Nike is no different. However, StockX’s data, a popular resale platform, noticed a drop in Nike and Jordan purchases YoY between 2023-2024 by 21% and 22%. This is only more concerning when you see that other brands like Adidas and Asics have skyrocketed in that same time horizon.

Sneaker brands have a unique indicator in that resale value provides another angle on demand. As Nike’s modern and vintage collections lose their audience, it seems to make a powerful statement on their clout and swagger.

A Case for Value Investors – New Balance

A boom in price after an era of depressed stock is an argument that could be made for just about any company. In the case of Nike, I believe they have a more compelling argument for a future boom than most companies for two main reasons: unpredictable fashion trends and a fellow competitor named New Balance.

A boom in price after an era of depressed stock is an argument that could be made for just about any company. In the case of Nike, I believe they have a more compelling argument for a future boom than most companies for two main reasons: unpredictable fashion trends and a fellow competitor named New Balance.

A stir of ingredients might explain the surge in demand for NB: from an uncompromising product of quality and comfort, a dad-shoe release by Balenciaga back in 2017, or a unique business model based on handpicked partnerships and athletes, all of these are contributing factors to the brand’s recent popularity. Of course, this swift capitalization is thanks to the final ingredient: an experienced management team. Coincidentally, Nike also seems to be following this approach.

New Balance’s CEO, Joe Preston, and CMO, Chris Davis, have tenures of 30 and 17 years. Both of whom are widely credited for NB’s diversification of product and ability to capitalize on current market trends. Nike appears to be following the same path with Elliot Hill as CEO and Nicole Hubbard Graham as CMO, bringing back folks with tenure of 30 and 17 years in their respective companies.

Given that fashion is fluid and ever-changing, combined with a management that understands what makes Nike tick, it will be difficult to discount the idea that Nike will make its comeback after a long lull.

Summary

Nike has its past, present, and future haunting investors. Recovery from wholesale mistakes, new competitors, government supply constraints, and the steady decline in sales and brand name suggest more turbulence for Nike. It seems that investors share the same sentiment, as stock prices have yet to show a true recovery from their highs in 2021. Not only do all of these factors show an uphill battle for a beast of footwear, but they are also potential signs of the fall of Nike’s long and mighty reign.