Tesla is hard to ignore. So I won’t.

I wanted to perform an analysis on the macroeconomics of Tesla because I think it’s often ignored. People will stare at their margins or Elon Musk as a sign of guidance, but I believe that leaves a huge blind spot to larger market trends for investors. With this analysis, I aim to shine light on the bigger picture and where Tesla sits amid the financial seas.

Macroeconomic factors that play into EVs for the future:

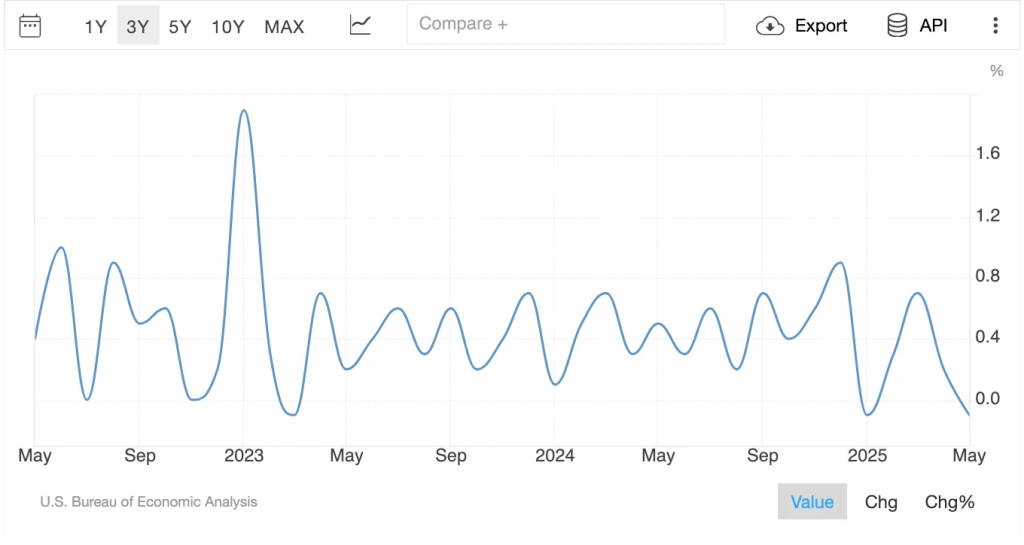

I. Consumer Spending limited to the US

Starting with consumer spending, I wanted to draw attention to three indicators: Volume of auto loans, personal spending, and consumer confidence. All of which are telling the same story, a steady downtrend representing consumers planning to and are spending less. Even more alarming, the volume of auto loans is also steadily decreasing.

II. Lithium, Nickel, Cobalt

Lithium, nickel, and cobalt are key components that go into EV batteries. From the graph, we see a downtrend in the prices of key components of EVs. On one hand, a price decrease can ease the pressure on margins for EV companies. On the other hand, it can also be used as a tale of supply and demand. Specifically, as prices decrease, the demand for these commodities decreases, or there is an oversupply of materials. Either way, demand is behind supply, a negative signal for EVs.

III. EV tax credits + Oil prices

As I write this, Trump’s tax bill is being debated with an aggressive push to pass. This bill includes the removal of EV tax credits. There are strong reasons to believe that this bill will be passed and put on Trump’s desk by July 4th.

Meanwhile, oil prices have been on a continuous downtrend, which can lead to a decrease in the price of gas at the pump.

With lower gas prices potentially on the way and a lack of tax credits, this might incentivize drivers to stick to the gasoline world as opposed to buying into EVs

IV. World Sales

There has been plenty of noise that Tesla sales in Europe are tanking. Interestingly enough, though, the top 3 consumers of Tesla cars have been the US, China, and Australia (after overtaking Germany in 2023). That said, if we decided to look into the US, China, and Australia Tesla sales, we notice a steep decline in sales.

Furthermore, BYD, a Chinese EV company, has surpassed Tesla in EV sales by double. Now, not only is Tesla losing sales, but it seems to be losing sales to another competitor.

Summary

Car loans, consumer confidence, and United States personal spending have been trending downwards. Important commodities are decreasing in price, which can ease margins but reinforces that the demand for these materials is decreasing or there is an oversupply. As EV tax credits are being pushed to be removed, oil prices are signaling a potential for lower gas prices. This bill will likely give fewer consumer incentives and increase competition. Finally, a major decrease in sales worldwide, and a competitor taking the international demand by storm.

My Take

Historically, this is a stock that rides on the delivery of past promises and aggressive investor confidence. However, the broader market is looking grim for the company. With an uphill battle ahead, it will seriously test the investors’ loyalty to Musk and Elon. Tesla may turn to a more subtle business model with robotaxis or energy storage as the EV market looks for other suppliers. These numbers are far from the collapse of Tesla but it may be the signs of a turning point for one of the Mag 7.

Upcoming events to watch

- Removal of EV tax credits

- OPEC+ oil supply decision on July 6th

- Progress of Robotaxis